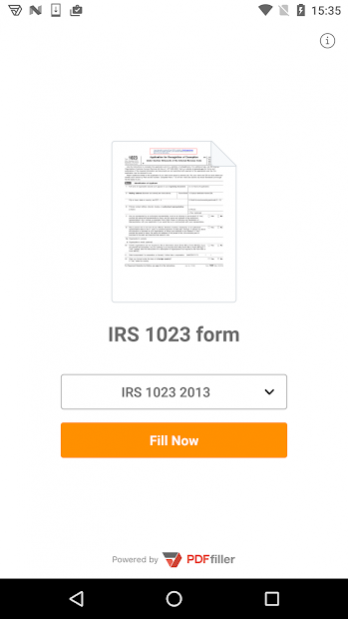

PDF Form 1023 for IRS: Sign Tax Digital eForm 1.9.3

Free Version

Publisher Description

According to U.S. federal law, there are 29 types of nonprofit organizations

Tax section 501(c)(3) of Title 26 of the U.S. Code claims an exemption for corporations, trusts or unincorporated associations established for nonprofit purposes. IRS Form 1023 is the Application for Recognition of Exemption . You may be eligible to e-file this form if your organization is qualified as religious, scientific, educational, charitable, etc.

If you need to find out whether your firm has a right to apply for an exemption, it’s more advisable for you to complete IRS Form 1023-EZ (The Eligibility Worksheet) first. After approval, the IRS provides a letter with a written assurance of the organization’s tax-exempt status. This qualifies the entity to receive tax-deductible charitable contributions. Every entity, that is qualified for exemption may be also classified as a “public charity” or as a “private foundation”. Such organizations are not allowed to perform any activities for or against political candidates.

To avoid routine and time-consuming paperwork, use a free online tax management app available for your Android device. No registration is required.

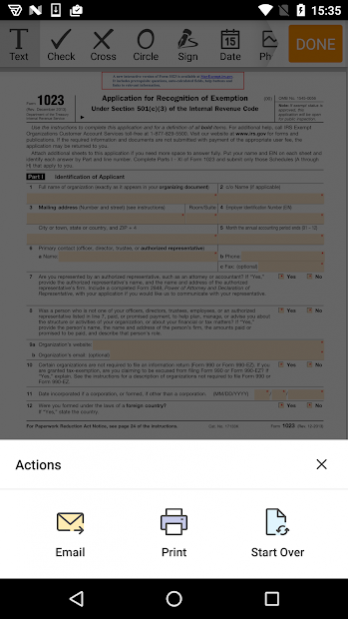

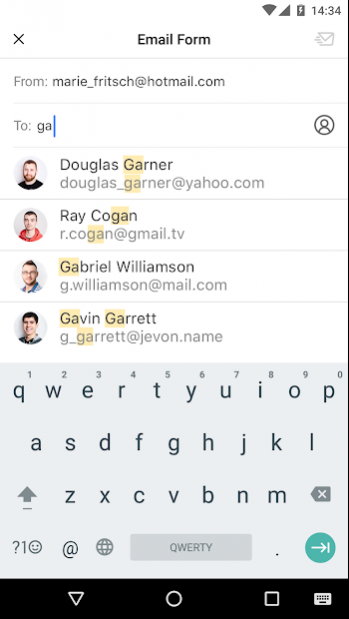

File your return quickly and safely by using the following features:

✓ Type anywhere on the document;

✓ Use powerful tools to add checkmarks, lines or arrows;

✓ Date the document automatically;

✓ Sign the form in a single click;

✓ File the document or print it out in less than a minute.

To complete your 1023 form in PDF you must insert the required information into the fillable fields:

✓ Organization data: date of creation, structure, country;

✓ Description of all activities;

✓ Employees and compensation;

✓ Members and individuals receiving benefits;

✓ Financial information;

✓ Related documents (articles, associations, agreements).

Note, that churches, including temples, synagogues and mosques are considered tax-exempt under section 501(c)(3) even if they don’t file a printable 1023 form. In addition, any foundation with gross receipts of no more than $5,000 per year do not need to submit this file.

About PDF Form 1023 for IRS: Sign Tax Digital eForm

PDF Form 1023 for IRS: Sign Tax Digital eForm is a free app for Android published in the Office Suites & Tools list of apps, part of Business.

The company that develops PDF Form 1023 for IRS: Sign Tax Digital eForm is airSlate, Inc.. The latest version released by its developer is 1.9.3.

To install PDF Form 1023 for IRS: Sign Tax Digital eForm on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2022-02-01 and was downloaded 11 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the PDF Form 1023 for IRS: Sign Tax Digital eForm as malware as malware if the download link to com.pdffiller.singleform.form1023 is broken.

How to install PDF Form 1023 for IRS: Sign Tax Digital eForm on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the PDF Form 1023 for IRS: Sign Tax Digital eForm is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by PDF Form 1023 for IRS: Sign Tax Digital eForm will be shown. Click on Accept to continue the process.

- PDF Form 1023 for IRS: Sign Tax Digital eForm will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.